When the web was younger Insurance advertising was much easier for advertisers. Around 2000 or 1999 the pay per click model for search traffic was just evolving and advertisers could buy clicks for a fixed price. We could buy a set of keywords for $0.65 per click. The search engine would then place our ad at the top of search results. When a user clicked on our ad it cost us 65 cents. We bought a contract for 1 year at a time! This was a sweet deal.

Back then everyone’s goals were simple. We wanted policies and were told to pay no more than about $250 each. The search engine wanted to get the most money per user click. The math was SO easy. If at least 1 out of every 380 users buys a policy then we were happy. Our web site actually sold policies (very rare then) and it worked well.

Google, and later Overture/Yahoo, came along and changed everything. Google wanted to make more money. They began displaying ads so that each day they made the most money. If users responded poorly to an ad (no clicks) search engines charged more for clicks or displayed other ads that made them more money. Finally users got a stake in the game. Real-time auctions began for each search word. The math was a little more involved but, still, was like algebra.

Oh, but now, the math has become almost impossible. Advertisers know SO much more than just the search word. Often users provide information like age, location, current insurance policies, number of cars, … and so on. Advertisers can know what Environment users have recently experienced such as sites visited, other ads seen, other media that this consumer has experienced. With all this information, what formula could possibly calculate a bid (a bid that makes money for the advertiser if this user clicks)?

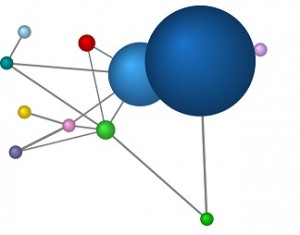

The DAG of a Bayesian Network can help make this type of decision. Here is an example DAG:

Visually a DAG is a very helpful kind of math. It is a very compact way to present relationships. They can help show what information is vital to calculating a bid and which variables with modest impact on a bid. BNs can be used as an inference engine for bidding.

The more you know does not always make for an easier decision. But when an insurance advertiser adds policy data to this model, then they can estimate how valuable a particular user will become if they click. Insurance companies value the assets new policies bring. They want to grow their book of policies and grow their Assets. GEICO produces assets for Warren Buffett to invest.

Estimating the probable assets per user with a Bayesian Network would be a great way to bid.

Leave a Reply

You must be logged in to post a comment.