Bayesian Networks

Since I was a student of mechanics and physics a better understanding has emerged. Hamiltonian and Lagrangian math has revealed a single method from which the “Laws of Nature’ can be derived. The method is to choose a coordinate system, write the Hamiltonian, assume some initial conditions and then solve the “Saddle” equations. This calculus has been used to derive Newton’s Laws of Motion. It solves 3 body celestial problems, solves any mechanical device’s future motion, it explains solutions in quantum mechanics, all of Maxwell’s equations, Kirchhoff’s principles, Fourier’s heat transfer. I have not seen this math applied to business. The Laws of Motion of business would predict future states of the business. This math could be very helpful to managers wishing to obtain better performance from the company. Since business is the practice of goal seeking they really want to control the business so that some performance is maximum. Hamiltonian math can find the optimal control u(x,t) that will produce maximum performance. It also can produce the trajectory of variables in business. These are the laws of motion. To begin we need to pick a coordinate system that will describe the business. Business already uses a host of metrics to account for its states. The English language surrounding business also seems a natural fit for the problem. The main coordinate for business is cash. Let cash be free Energy. Free cash flow is a company’s production of Free Energy. Energy, Entropy and Temperature The physical world is well described using models that involve Temperature, Entropy and physical coordinates (Voltage, pressure, volume, conductance). A Carnot Heat Engine is a simple model of how to extract Work from a Temperature potential. Here entropic forces generate work from a machine between two temperatures. Electric circuits dissipate energy when entropic forces push current through an conductance. Potential energy causes current to flow through the conductance which dissipates energy. This figure models a business using the same language (coordinates). Imagine businesses are bubbles that conduct business by touching after agreement on terms: N, t, and price. This price is phi. Rho is the conductance that allows a given flow rate. The product of N and phi is cash flow or change in energy. Likewise I think a model business will include Entropy along with business metrics (Sales, Costs, Budget, Market Cap, Goodwill, Risk) and can be very helpful for making decisions. Fundamental Equation of Business Potentials For a time period τ the change in value of a business dU is the change in internal energy less the cost of work plus the change in sales plus changes forced by external variables. U is business valueQ is internal energy of business including cashW are costs of operationsϕ_i is price paid by customer iϕ_j is price paid to supplier jN_i, is number of units sold to each customer i. It is a vector with length i. Sales Sustainability and Sales Caliber Investors and business managers insist on sustainability. They hate risks to ongoing sales. Business managers reduce sales risk by selling to many customers and then distributing sales to its customers. I propose using Sales Caliber as a measure of a business’s sales sustainability. Sales Caliber is the Shannon Entropy of the Sales Distribution (named “Caliber” by E.T. Jaynes). Three example sales distributions are shown below. Business/Marketplace C has fewest customers and 95% of sales are to one customer (intense sales concentration risk): Caliber of Sales, S, is a direct measure of the certainty of future sales. Likewise, 1/S, is the Risk of future Sales. If T is profit margin, then TSN represents business’s potential energy from future sales. Caliber is a continuous measure of sustainability making it a very helpful metric for business managers. Said another way: Goodwill = T x Sales Caliber x N The change in internal energy is the sum of the margin T times change in Caliber S plus the Caliber S times the change in margin T. Business Value as Total Energy If we take the Fundamental Equation, substitute the above, and integrate over time tau or over N, we get: These equations simply sum the energy provided the business in the form of potentials. These are the energy equations of business with external forces excluded. Business Performance Measures Most of standard business metrics can be found by knowing the value of each variable in the energy equations. Here is a selection of business performance metrics. Optimizing Business Performance Every business is seeking a goal and I think success comes mostly to business with well considered goals. Here are the variables of the business: Not all of these variables are accessible to the business. Example, in an auction setting the customer sets the price phi i. Typically some performance J is to be maximized over the next month, quarter, or next several years (over some time period τ). Imagine that the goal of a young business is to produce maximum TdS each quarter whatever other y may become. Then the performance function is: f(y,t)=TdS. The business does this by changing the vectors σi and Ni . This maximum can be computed very quickly and will have an optimal Ni * distribution of product given the goal. This maximum occurs when the partial derivative of f with respect to Ni is 0. Ni is our control u below: This solution was very easy with no constraints. Real business goals most often have constraints of allowable business states. In the above J we might add a constraint that gross profit margin T must be > 13%. But still the last expression is true del f /del u = 0 Another goal might be to maximize gross profit. To accomplish this goal, the entropy of the business is depleted (exemplifying that it is potential). To maximize gross Profit by adjusting Ni, we simply deliver all N units to customer with greatest price ϕi. The entropy of such a distribution is 0, produces maximum temperature T and is least sustainable state of the business with S=0. This is a bad goal without constraints. The Hamiltonian Now that we have a general form for performance J and the energy equations of business, we can write the Hamiltonian: with performance function f: The Hamiltonian is: If a pair (u*(t), y*(t)) is optimal then there exists a continuously differentiable function λ(t) such that: Business Laws of Motion These partial differential equations predict the final state of the business when management applies changes to a control. In our example the control u is Ni, and the prediction is the optimum Temperature and change of Entropy (T*,dS*) given the performance goal of the business. They are a way to calculate values of all other variables of the business model at time: The function λ(t) is a Lagrangian transformation. We begin finding the optimal control using the last equation and then calculate each other variable in y using the first two equations. To be clear, a business has a limited number of variables y that it can control and which describe it’s periodic performance. Any ‘law of motion’ will include the variables in the energy equation of the business. The laws of motion y(t) and y’(t) can be calculated by solving the Hamiltonian differential equations on a computer with Python. Those variables in y not in the control can be forecast or predicted. Lastly The equations of motion of a business predict the state of business after a time τ. By applying a performance function and the energy function (aka business potentials) of the business to form the Hamiltonian, we can then estimate the state of all other variables in the collection y. TSN + cash is the potential energy of a business. Free cash flow is kinetic energy. It is clear that a company should optimize it’s distribution of products to produce Entropy. “The goal of business is to produce entropy”. Who said that? Seems that in business Entropy can decline if managers choose to begin selling product to fewer customers or if customers choose to stop buying. A more modern accounting of business would include formal reporting of TdS and dTS, and TSN. Investors are more interested in future potential of the business. This is best estimated with the internal energy TSN which is the business asset Goodwill which encompasses: (price, distribution, volume). References Wayne, James J., 2013. “Fundamental Equation of Economics,” MPRA Paper 50695, University Library of Munich, Germany. Kirk, Donald,J., 1967, “Optimal Control Theory”, Prentice Hall Hamill, Patrick, 2014, “Lagrangians and Hamiltonians: A Student Guide to”, Cambridge University Press Jaynes, E.T., “The Minimum Entropy Production Principle“, WikiPedia, “Thermodynamic Potential“,

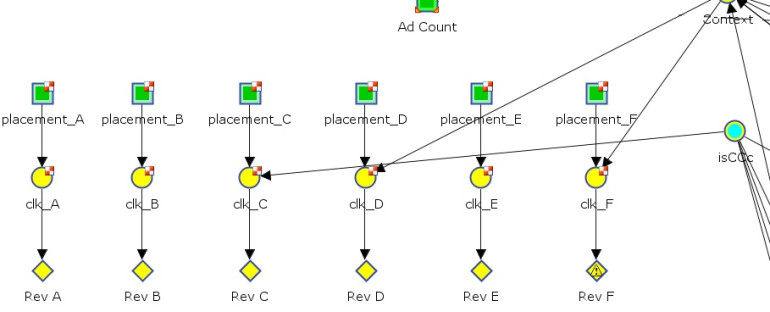

For a long time now, I have been interested in modeling of businesses. In particular the SureHits business model of a click marketplace.

Ad Servers play a big role in the profitability of many media companies. Many of these media companies are niche companies with narrow audiences and have fewer advertisers than, say, a mega media company like Google. For these blogs, I am specifically discussing niche media companies where the number of eligible ads is small.

Ad Servers perform two functions that produce value The number one function is to produce Profit.

E. T. Jaynes renames Entropy to Caliber “As the possible World-lines in phase space-time of each mircostate and its known history come together at the present, they form a tube from which events emerge into the future. The area of the cross-section of this tube is the Caliber.”

Ad selection for n ads is NP hard When an ad server has n eligible ads for display for k available slots, the possible choices for ad sets becomes exponential.

It has been a decade since we used very simple models for ad serving. Even then, with simple models, we produced great results. I did not realize it then, but we were using simple Causal Inference to make our estimates.

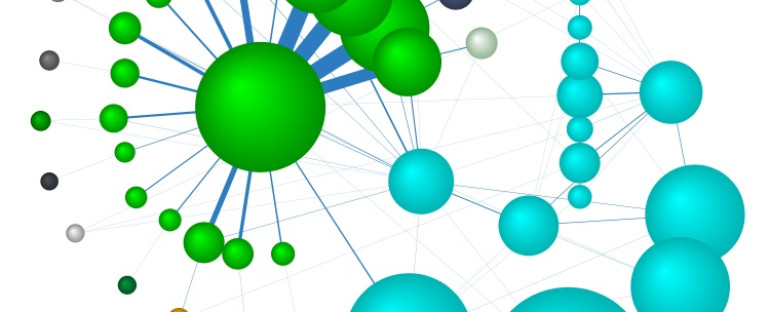

Entropy and a Book of Orders In thermodynamics, Heat, Temperature, Pressure, Work and Entropy are the main ensemble of variables that describe how mechanical/cyclical engines operate. The second law of thermodynamics was a big deal when it was discovered. The models of the cycle of these engines sparked the industrial revolution. Example the Carnot Heat Engine. Chemistry and chemical engineering fields also enjoyed a boon of discoveries and applications and products. All these are bound and constrained by this notion of Entropy. Around the same time, late 1800s, Willard Gibbs ‘discovered’ the same Entropy in statistical models of the world. This statistical Entropy worked the same way as physical entropy. Later in the 1950s Claude Shannon ‘discovered’ Entropy at Bell Labs as it relates to communications (conveying information). This entropy also obeyed the second law. Again it was a boon to understanding and building communication systems of all kinds. I think that in the business world probabilistic models can be applied to model cyclic processes like click advertising and lead generation (supply and demand problems). Gibbs Entropy, I believe, can be used to understand the limits, constraints and optimizations of the process. I believe that these business cycles will indeed obey the second laws of thermodynamics. The ensemble of Variables in advertising: Profit, Profit Margin and Entropy are analogous to Work, Temperature and Entropy in engines. Humans seem to understand entropy well. We are constantly weighing options while we all seek our own utility. Acting to get more energy than we expend. We watch around us as once ordered things decay, rust, stop working, crumble. Famously, Claude Shannon at AT&T made the the connection between Entropy, bandwidth and information content. I have abducted his Theorem (actually others are calling it Gibbs-Shannon Entropy) and eagerly explore this same entropy as an oracle for decision making for optimal consumption, in this case, an optimum ad serving strategy. I think we can calculate the value of a Book of CPC advertisers using Entropy. The Book is the full collection of all your CPC client Orders. “Book” for short. Temperature of the Book T is the difference between Sales (RPV) and Cost (CPC). Total Book value = Sum of (Entropy x T) This concept applies to certain difficult marketing businesses. An example system is Ad Serving, the business of choosing the ads to place on web pages given a Book of Ad Orders X, an uncertain supply of page views, ad placement and ad responses Y, and an uncertain user demographic and context variables Z, where Z∈Y. Likewise applicable is the internet Lead business where a Book of Orders for Leads X is sold into an uncertain supply of Leads and lead disposition variables Y that also have uncertain lead demographic and source (context) variables Z, where Z∈Y. In these businesses the Book of Orders (Book for short) is a company asset. It fairly can be put on the company’s Balance Sheet as the predicted sum of profit from the full depletion of the Book. It presents the ability to generate revenue in the future. The marketer’s goal is to deplete this Asset and produce the most profit for the company from this asset. I propose that the value of this asset is proportional to the Entropy associated with the Book of Orders. The value of the Book is product of the associated Entropy H(X) and the expected gross profit of a sale (Sales TX – Cost of Sales WX – Cost of Goods TY). Value = ∑z H(X) ( ΔT – WX) analogous to Total Energy = Σ H(x) Δ T And here are some framework notations for a Book of Orders: Let us define the common parameters of Orders and of supply. The probability of a match for Order xi = p( xi | z) where z are the order selection variables in set of Z where Z∈Y. We know that the probability of a match is the probability that supply Y is in the same demographics, so p( xi | z) = p( Y|z). Probability of a match is based on supply. Txi is the price of Order xi. Let n be the quantity of the Order or the maximum acceptable quantity in a time period. And TY(z) is the expected Cost of an instance of the supply yi(z). Profit for a filled order = Revenue – Cost of Revenue – COGS= Txi – TY(z) – WX Y contains a set of response variables and Do variables that denote a sales funnel which form a Markov chain ( y1 –> y2 –> y3 …). Entropy associated with Order x = H(x) = n ∑x∈Y – p( Y|x ) logb p( Y|x ). Note that if an order falls outside of Y (x∉Y), the Entropy associated with x is zero and the order will have no value. Maximum entropy occurs when p(Y|x) = 1/2. Using log base 2 gives units of bits for the entropy. However, Jing Chen, in his paper “The Entropy Theory of Value” says that b is the number of producers of Y. hmm. Equity of an Order Equity is Energy. Relative Temperature is ΔT = TX – TY or the difference in sales and cost (gross profit). The Balance sheet Equity E that is generated by an new Order is E = ∑z H(xi) ( Txi – TY(z) – WX) or E = ∑z H Δ T or Equity = Entropy x Change in Temperature Likewise Equity is produced if Entropy increases while Temperature is held steady. E = T Δ H The per Unit value of a drawn lead or page-view is V(Y|x) = – log2 p( Y|x ) is the log likelihood of a match and is = the number of true/false questions needed, on average, to guess if a match for order x has occurred. Equity of more than one order – a Book Entropy of two Orders x1 and x2 = H(X) = H(x1 ,x2 ) In general, H(x1 ,x2 ) ≤ H(x1 ) + H(x2 ). This means the book entropy can be less than the sum of entropy for each order. Equality occurs when x1 and x2 are independent. When two Orders overlap they have mutual information I. H(x1 ,x2 ) = H(x1 ) + H(x2 ) – I(x1 ;x2 ) where I(x1 ;x2 ) is the Mutual Information of the two orders. By Chain Rule, the Entropy of three Orders = H(X) = H(x1 ,x2 ,x3) = H(x1 ) + H(x2 | x1) + H(x3 | x2 , x1) The chain rule offes an algorithmic approach to calculating the Entropy of a Book. The series has k calculations. Book Entropy of k Orders = H(x1,x1,x1,…, xk) Total Value of a Book of Orders = ∑x H(X(x)) (ΔT(x))

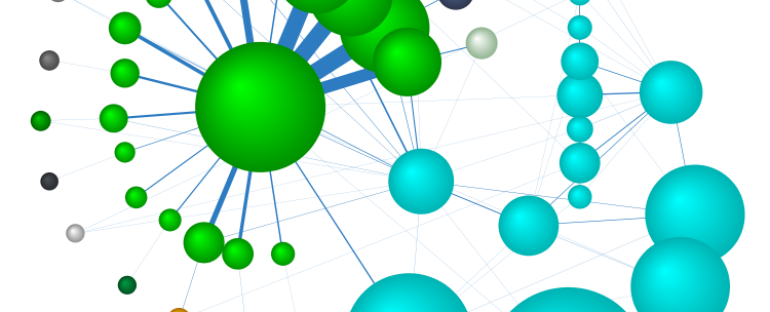

Intelligent Marketing Manifesto Effective marketing of products is the art and science of making decisions. Marketers make these decisions using past experience or data. The outcome of their decision is uncertain. The goal is to produce utility by either making their company more valuable by increasing the company Equity or, more greedily, to maximize net profit for the period. When the marketer is confronted with choosing between two options A or B, how should they decide? Obvious Answer: They Do A or B based on their model of the world. They have a formula which calculates the likely utility of each decision and they choose, or Do, the option with greatest utility. But, I argue, that this is not the correct approach. It seems obvious that the decision, Do A, or Do B, is the one with greatest utility. The correct approach to this decision involves Entropy H. A more realistic setting is a constant ‘flow’ of choices – a stream of decisions. The intelligent marketer wants to look into this uncertain future and ask, “how do I make each decision so that the Total effect of my decisions is to maximize utility over time?”. Each marketer is constrained by their inventory or by their standing orders (Book of Orders). It is the rarity of their collection of products or the rarity of fulfillment of standing orders that also drives the marketer’s ability to produce utility. The probability that A will occur is p(A). The Entropy of A, H(A) = – p(A) log p(A). An excellent measure of Rarity is 1 / H. Marketers often have many options, A to Z, for every decision. For ad servers the number of possible options can be extraordinarily large and ad placement decisions must be made very fast. Online auctions also present the marketer with bidding decisions that must be made in near real time when the product being purchased has extraordinarily large possible variations such as keywords or lead auctions. This blog’s goal is to offer the marketer methods to always make intelligent decisions. Intelligence here is using Bayesian updating to update their model of the world given new evidence (or conditions). Intelligence is about effectively managing inventory (Entropy) too. Intelligence is maintaining your system in its highest possible state of Entropy and depleting this Entropy in the most efficient, most profitable means possible given the uncertainty of supply. I believe gravity is an entropic force in nature. So imagine two bodies with mass in a space. The entropic force of gravity assures that the system’s entropy will decline as the two bodies are attracted together. Ultimately the force of gravity assures that the two masses merge and the entropy of the mass distribution in the system reaches it’s minimum. Erik Verlinde suggests that: “Gravity is explained as an entropic force caused by changes in the information associated with the positions of material bodies.” Likewise I think that there are economic entropic forces at play in business and economics. Intelligent Rules of Marketing Rule 1. Intelligent decisions produce the most Utility per Entropy expended by a system. Corollary 1. When managing a book of standing orders (a Book) and two or more orders match an uncertain inventory, sell to the Order with the greatest Utility per Entropy expended from the Book. Each filled order will reduce or deplete the entropy of the Book. Each new order may add to the entropy of the Book. The total entropy of a Book of Orders is proportional to the Equity of the Book. Corollary 2 : In game play: If two different moves produce the same utility, choose the move that will result in the greatest freedom of action of future moves. Corollary 3: A high entropy book of orders will offer more matching options and will have higher value than a low entropy book with fewer matching options. The value of a new order is the Margin ÷ the Entropy it will add to the Book of Orders. Corollary 4: Rarity is Value. The rarity of an object causes the human mind to assign it more value than a less rare object. Rarity = 1 / Entropy Rule 2. When adjusting your model of the world, use Bayesian Updating. It is the best and you can do no better. Bayes Theorem. Rule 3. When choosing between two models of the world that equally fit the evidence (data), the least complex (the one with least assumptions) model is more likely correct. The best model maximizes: Data Fitness – Complexity. Rule 4. When making a decision where many variables seem to drive a probable outcome, use Do Calculus to predict the results. Directed Acyclic Graphical Models make good choices for a model of the world. These models can be learned from data using, in part, the Conditional Entropy (Mutual Information) among the variables of the data. In the future I hope to publish blogs on each of these ‘rules’. And as I do, I will link these updates on this page. Entropy is a vague concept for most people. I hope in these blogs I can, if not demystify, offer tangible reasons to use Entropy in your marketing decisions. Please add comments and suggestions for improvement. I need your help, input and corrections.

Part 3 – Estimating Lead Gen Revenue In the field of insurance, companies grow by building a collection of policies. This collection is called a Book. So an established and successful insurance agent will have a large Book of Policies. This Book defines the present value of the agent’s business.

About The Garden

People are hungry in Edmond, Oklahoma. It is our hope to provide a source of nutritious fresh food by serving local food banks.

The garden sits in the bottom of Chisholm Creek and shows great promise with great top soil and a nice flat 1/2 acre for cultivation.

Recent Posts

-

Good High Value Home Insurance: Options and Plans

EconomicsOver a long and lucky life I have accumulated a lot...

-

Fundamental Equation of Business Potentials

Bayesian Networks, EconomicsSince I was a student of mechanics and physics a better...

-

Have you ever seen mountains?

In the Weeds, The Garden BlogWhat is this monster slouching towards Bethlehem from...

About Elm Tree Garden

People are hungry in Edmond, Oklahoma. There were times as a child that I was hungry. People don't get enough fresh vegetables. It is my hope to provide a source of nutritious fresh food to my community of local food banks, kitchens, friends and family.

The garden sits in the bottom land of Chisholm Creek and has great top soil and a nice flat 1/2 acre for cultivation. We have added a water well, irrigation and electricity.

The setting is my favorite reason to garden here. The old elm tree shades a nice sitting area from which to view the garden and the rich nature that comes and goes in the bottom.

From The Garden Blog

-

Good High Value Home Insurance: Options and Plans

EconomicsOver a long and lucky life I have accumulated a lot...

Best Production So Far

- Sweet corn - 700 ears

- Onions - 150 pounds

- Garlic - 50 heads

- Red Shallot - 50 lb

- Cantaloupe - 50

- Peppers - 25 boxes

- Summer Squash - 3 boxes

- Tomatoes - 15 boxes

- Okra - 25 boxes

- Green Beans - 8 boxes

- Blackberries - 6 boxes

Give to Food Banks

Even in prosperous Edmond, food banks do a steady business serving the poor. Most efforts are operated by volunteers. They almost always need help. Please give cash or volunteer.

Great examples:

Regional Food Bank: where you can donate or volunteer.

Other Options, Inc. in OKC

Project66 Community Food Pantry in Edmond